PureHealth has reported its financial results for the period ending 31 December 2025, and proposed distribution of a cash dividend valued at AED600 million for the 2025 financial year, subject to regulatory and shareholder approvals.

The group reported revenue of AED27.3 billion, up 5.7 per cent year-on-year, reflecting strong performances across both its Healthcare (Care) and Insurance (Cover) verticals throughout 2025. EBITDA increased by 16.1 per cent year-on-year to AED4.8 billion on the back of continued efficiency gains as well as the contribution from HHG in Q4-2025. The group’s net profit grew 17.7 per cent year-on-year to AED2 billion, while pretax profits grew 26.1 per cent year-on-year to AED2.2 billion

This strong performance underpins PureHealth’s proposal to distribute dividends equivalent to approximately 30 per cent of its net profit, to be paid in two equal semi-annual instalments. The proposed dividend framework is a direct reflection of the strength of the group’s balance sheet, its recurring earnings base, and its cash flows across market cycles.

The dividend proposal is the outcome of deliberate scale, sustained performance, and disciplined capital allocation as PureHealth continues to execute its long-term growth strategy as a listed global healthcare group. PureHealth operates across the UAE, US, UK, Greece, and Cyprus, supported by rising patient volumes, expanded clinical capacity, specialised services, and continued investment in AI-enabled healthcare delivery.

His Excellency Kamal Al Maazmi, Chairman of PureHealth, said: “2025 marked an important step forward in our ambition to shape a truly global, technology-enabled healthcare group. As PureHealth expands into strategic international markets and strengthens its specialised care capabilities locally, we are laying the foundation for a more connected and resilient healthcare platform. The proposed dividend policy reflects the board’s confidence in the financial strength PureHealth has built and our commitment to delivering sustainable shareholder value while maintaining the flexibility to invest in long term growth.”

Farhan Malik, Founder and Managing Director of PureHealth, said: “Resilient financial performance and a strong balance sheet underpin our disciplined capital deployment. Whether investing organically in technology, AI and capacity, or inorganically through value-accretive acquisitions, we are driving stronger shareholder returns while bringing leading clinical practices to the UAE and the markets we serve. With c.50 per cent of assets now outside the UAE, PureHealth is a truly international business with diversified revenues across markets and currencies. This performance enables us to reward shareholders with a dividend of AED600 million while continuing to invest in the next phase of PureHealth’s local and global expansion.”

Shaista Asif, Group Chief Executive Officer of PureHealth, said: “Our 2025 results demonstrate how PureHealth’s Care and Cover model converts scale into resilient earnings, strong cash generation, and measurable synergies across multiple markets. We delivered growth across the UAE, solid turnaround in financial performance in the UK through Circle Health Group, and the successful acquisition of Hellenic Healthcare Group across Greece and Cyprus. The scale of digital solutions and AI deployment we are implementing is creating a distinctive platform that sets us apart from major international providers, positioning us well ahead for the new era of AI-powered healthcare.”

Within the Care vertical, in the UK, Circle Health Group delivered solid turnaround, driven by accelerated performance across inpatient, day-case, and outpatient services for FY-2025. In Greece and Cyprus, Hellenic Healthcare Group demonstrated strong early momentum, with an uptick in patient volumes, driven primarily by outpatient growth. Hellenic Healthcare Group contributed AED742 million in revenue and AED152 million towards the group EBITDA in Q4-2025. Both Circle Health Group and Hellenic Healthcare Group are operating at an EBITDA margin greater than 20 per cent, therefore making both the acquisitions value accretive to PureHealth.

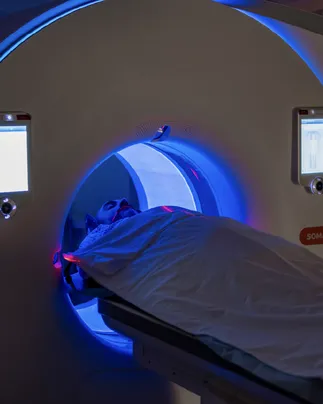

Across the UAE, the group broadened its healthcare footprint. PureHealth opened additional speciality clinics, increased inpatient and outpatient capacity, upgraded diagnostic services, and expanded its surgical capabilities across multiple specialities, ultimately leading to a rise in outpatient and inpatient capacity. Outpatient and Inpatient volumes increased by 15 per cent and 14 per cent year-on-year, respectively, in FY-2025. Additionally, lab volumes increased by 17 per cent year-on-year, surgical volumes rose 17 per cent year-on-year, and occupancy across UAE hospitals grew three percentage points to 74 per cent. The UAE network is focused not only on building capacity to meet increasing volumes, but also on developing multiple sub-specialty services, positioning it as a destination for high-quality specialist care.

The Cover vertical delivered solid growth, with revenue rising 13.5 per cent year-on-year to AED7.8 billion in FY-2025, supported by strong renewal trends and ongoing growth in new customer enrolments, highlighting continued momentum across the market. This resulted in a 6 per cent year-on-year increase in memberships to 3.4 million, alongside a 9 per cent year-on-year increase in gross written premiums, which reached AED7.6 billion.

Key highlights of PureHealth include its Daman expansion, strategically into the high-growth Property and Casualty insurance segment.

PureHealth completed an EUR800 million equity value acquisition of a 60 per cent stake in Hellenic Healthcare Group, a leading healthcare group operating 11 hospitals and 23 diagnostic centres across Greece and Cyprus.

It also strengthened Circle Health Group’s clinical footprint through the bolt-on acquisitions of Fairfield Independent Hospital – adding 28 beds and two operating theatres – and Meriden Hospital Advanced Imaging Centre, alongside the opening of new outpatient centres in Cheshire and Inverness.

PureHealth introduced the Pura Longevity Clinic to provide personalised, preventive and precision-based care aimed at extending healthy lifespan through advanced diagnostics and treatment programmes. It also launched nationwide virtual mental health services through its AI-enabled health app, Pura, supported by the largest network of licensed psychologists and psychiatrists across the UAE.

The group unveiled the UAE’s largest and most advanced AI-powered standalone diagnostic laboratory under its PureLab subsidiary. It also rolled out the pilot phase of the Nada AI tool to support clinicians with faster, data-driven decision-making by analysing medical information and enhancing clinical accuracy.

PureHealth launched the Abu Dhabi Health Research Centre (ADHRC) to drive cutting-edge medical research, clinical trials and health innovation in the emirate. In addition, it partnered with Dorchester Collection Academy to integrate luxury hospitality standards into healthcare environments, elevating patient experience standards.

Finally, SEHA entered a landmark strategic partnership with Cincinnati Children’s Hospital Medical Center to deliver world-class paediatric expertise to Abu Dhabi and the UAE. SEHA also deployed CyberKnife technology to deliver highly precise, non-invasive radiosurgery treatments for cancer and complex tumours.

PureHealth enters the next phase of its growth with a focus on scaling its global network, strengthening clinical specialisation, and accelerating the use of AI and digital technologies across its operations. In the UAE, the group will prioritise market share expansion across key platforms as well as capabilities enhancement and operational scale-up to enhance margins.

Internationally, PureHealth will continue expanding in high‑growth private healthcare markets, advancing a unified care‑and‑cover ecosystem, and realising efficiencies through standardised platforms and shared clinical best practice across its global assets. This expansion supports PureHealth’s clear ambition for international markets to contribute 50 per cent of group revenue.